FirstService (FSV)·Q4 2025 Earnings Summary

FirstService Beats on EPS, Stock Jumps 5% as Dividend Raised 11%

February 4, 2026 · by Fintool AI Agent

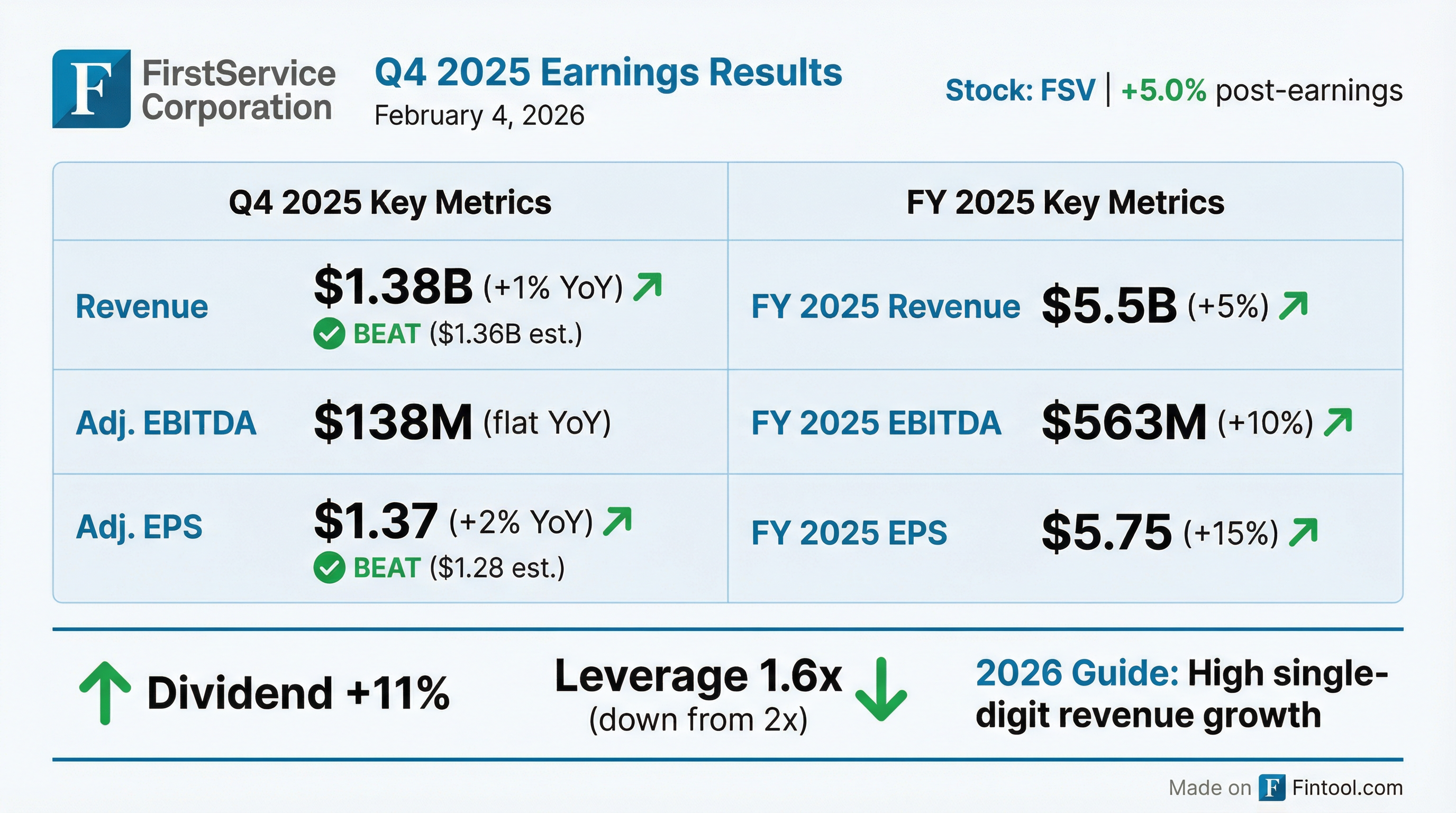

FirstService Corporation (FSV) delivered Q4 2025 results that exceeded expectations, with adjusted EPS of $1.37 beating consensus by 7% and revenue of $1.38B coming in 1.5% above estimates . The stock surged 5% to ~$162 following the earnings release, as management announced an 11% dividend increase and provided constructive 2026 guidance .

Did FirstService Beat Earnings?

Yes — FirstService beat on both EPS and revenue.

This marks the fifth consecutive quarter of EPS beats for FirstService, continuing a strong track record of exceeding Street expectations .

Historical Beat/Miss Record

What Were the Full-Year 2025 Results?

FirstService delivered impressive leverage on its P&L, with bottom-line growth outpacing top-line performance :

CEO Scott Patterson noted the company is "pleased with the growth we delivered on the earnings lines, notwithstanding the top-line headwinds we were facing throughout the year" .

What Changed From Last Quarter?

Several key developments since Q3:

Restoration recovery underway: After a challenging year with minimal named storm activity, restoration brands saw modest pickup in Q4 from Canadian claim activity. The recent winter storm is driving an "uptick in activity" that should push Q1 restoration revenues modestly above prior year .

Roofing stabilization: While organic revenues remain pressured (down 5%+ organically in Q4), management noted backlog has stabilized and expects "modest organic growth this year with sequential improvement quarter to quarter" .

Leverage improvement: Net debt-to-EBITDA dropped to 1.6x from 2.0x a year ago, providing significant firepower for M&A with ~$970M in liquidity .

Amenity services pressure: Some amenity management contracts (pool construction, concierge services) were not renewed at year-end, primarily with multifamily customers over pricing. This will pressure Q1 organic growth to 3-4% before normalizing .

How Did Each Segment Perform?

FirstService Residential (41% of Revenue)

The residential division delivered consistent mid-single-digit organic growth driven by net contract wins across North America . Full-year margin reached 9.8%, the upper end of the 9-10% target band .

FirstService Brands (59% of Revenue)

Century Fire Protection continued to shine with 10%+ revenue growth and high single-digit organic gains, benefiting from solid multifamily, warehouse, and data center construction activity .

Restoration (Paul Davis + First Onsite) revenues were flat sequentially and down 13% YoY, though excluding $60M from prior year storm activity, the business was modestly up .

Roofing was up a few percentage points on acquisitions but down 5%+ organically due to weak new commercial construction and delayed reroof projects .

What Did Management Guide?

Management provided detailed guidance for 2026:

By segment:

- Residential: Mid-single-digit organic growth for FY26; Q1 at low end (3-4%) due to amenity contract losses

- Restoration: Growth expected assuming normal weather patterns; Q1 modestly up from winter storm activity

- Roofing: Modest organic growth with sequential improvement; Q1 up mid-single digits, flat organically

- Century Fire: 10%+ growth for the year, spread evenly

- Home Services: Low-to-mid single digit revenue growth expected

How Did the Stock React?

FirstService shares jumped +5.0% following the earnings release, moving from $154.55 to ~$162.30 intraday.

The positive reaction reflects the combination of the earnings beat, dividend increase, and constructive 2026 guidance — particularly the return to organic growth expectations across most segments.

What Did Management Say About M&A?

M&A remains a focus but the company is being "very patient" in a competitive environment :

"Multiples are high, and there aren't a high number of quality companies coming to market. So we are focused on picking our spots and finding the right partners." — CEO Scott Patterson

Key M&A themes:

- Tuck-under focus: Allocated $107M on tuck-under acquisitions in 2025

- Partnership model: Seeking founders who want a "forever owner" rather than private equity resale

- Roofing opportunity: Some distressed sellers coming to market with lower valuations due to soft operating results

- No large platforms near-term: Focus on adjacencies within existing brands rather than new standalone platforms

Key Management Quotes

On FY 2025 performance:

"For the year, we reported solid results that we're proud of in the face of tough macro headwinds. Revenues finished 5% up over the prior year. Consolidated EBITDA was up 10%, double the revenue growth." — CEO Scott Patterson

On restoration outlook:

"We finished the year down 4% in restoration, relative to an industry that we believe was down over 20%. Our platform investments and focus on day-to-day service delivery continues to drive gains in wallet share with key national accounts."

On roofing competition:

"The competition has intensified. Certainly, there are fewer opportunities and more companies bidding, and it has compressed gross margins."

On residential margin trajectory:

"In terms of going above 10%, yeah, that's an opportunity over a multiyear time horizon for sure." — CFO Jeremy Rakusen

Capital Allocation Highlights

The 56% increase in operating cash flow was a standout, driven by working capital improvements and higher profitability. CapEx is expected to rise to ~$140M in 2026 .

Risks and Concerns

-

Consumer spending pressure: Consumer confidence index declined for 5 consecutive months through December, weighing on home services demand

-

Roofing margin compression: Intense competition from displaced new construction contractors is pressuring reroof gross margins

-

Weather dependency: Restoration revenues remain highly dependent on storm activity; normalized weather assumed in 2026 guidance

-

Amenity contract losses: Pricing-related contract losses in multifamily will create Q1 headwind

Forward Catalysts

- Q1 2026 earnings: Watch for restoration recovery from winter storm impacts

- M&A activity: Distressed roofing targets may present acquisition opportunities

- Century Fire growth: Continued data center and warehouse construction tailwinds

- Margin expansion: Potential for residential margins to push above 10% over time